Every Dollar Counts: From Silicon Valley To Lexington

When you ask someone to list where they think the largest concentrations of tech companies are in the U.S., most will respond quickly and correctly by including some form of Silicon Valley. For years, the San Francisco Bay Area and Santa Clara Valley, which together make up Silicon Valley, have become global hubs for high-tech business, innovation and entrepreneurship, and venture capital. In 2017, according to Pitchbook, San Francisco and San Jose together made up almost 45% of all venture capital investment in the nation1. With high-tech giants like Twitter, Salesforce, Facebook, Netflix, Adobe, Apple, and Google and proximity to almost half of the venture capital in the U.S., it would be fair to ask why a high-tech company would choose to locate anywhere other than the valley. One of the biggest reasons is purchasing power. Because of Lexington’s low startup costs, the city is an ideal destination for innovators joining the Silicon Valley Exodus. A dollar in Lexington goes way farther than in San Francisco. Tech entrepreneur, Bob Moore, has explored this concept in greater detail and calls it Venture Capital (VC) Arbitrage.2

VC Arbitrage is an approach to venture capital fundraising that involves raising funds from cities, like San Francisco and San Jose, where the benchmark for investments is the highest and spending those funds in a market where the inputs necessary for startup creation and growth are lower. VC Arbitrage works similarly to the stock market strategy, “buy low, sell high”. By using this approach high-tech startups can ensure they get the largest VC investment possible and receive increased purchasing power for every dollar raised.

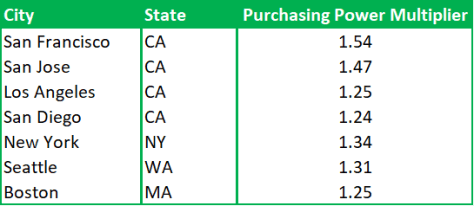

Based on early-stage financing and cost models for his previous startups, Moore has separated startup costs into 4 elements: Engineering Headcount (50%), Sales and General Administration Headcount (50%), Rent (10%), and Cost of Goods Sold/Other (15%). Using this methodology, he created the VC Arbitrage: Purchasing Power Calculator. The calculator allows users to compare the purchasing power of venture capital from one city to another. According to the VC Arbitrage tool, raising $1,000,000 in San Francisco will buy $1,544,095 of inputs in Lexington, giving each dollar 1.54 times the purchasing power.

Reasons similar to Moore’s are becoming ever more popular among west coast tech firms and venture capitalists. In March 2018, The New York Times published an article titled, “Silicon Valley is Over, Says Silicon Valley”3. The article’s writer, Kevin Roose, recaps interactions and insights from his recent journey through the Midwest with a group of venture capitalists from Silicon Valley. Roose notes that, “By the end of the tour, the coastal elites had caught the heartland bug. Several used Zillow, the real estate app, to gawk at the availability of cheap homes in cities like Detroit and South Bend and fantasize about relocating there.” Furthermore, he states that many more investors are flirting with relocating, or already have relocated, due to, “the exorbitant cost of living in San Francisco and its suburbs, where even a million-dollar salary can feel middle class” and a lack of “intellectual diversity”. Founder of High Ridge Venture Partners, Patrick McKenna, sums up the view of many investors saying, “It’s so expensive, it’s so congested, and frankly, you also see opportunities in other places.”

“It’s so expensive, it’s so congested, and frankly, you also see opportunities in other places.”

Patrick McKenna, Founder, High Ridge Venture Partners

Lexington is the ideal destination for high-tech companies and venture capital investors that are exhausted by the high business and living costs of Silicon Valley and are aching for release. As mentioned, locating in Lexington increases the power of every dollar a company raises by over 50%. The city’s low costs for labor, office space, and filing fees have ranked Lexington in the Top 10 cities with the Lowest Startup Costs by SmartAsset.com every year since 2015, never ranking below #8. In addition to low startup costs, according to the Council for Community and Economic Research (C2ER) Cost of Living Index, in 2018, the cost of living in Lexington was nearly 6% below the average for all U.S. metros and over 102% cheaper than San Francisco. Companies can find a better bang for their buck in both business and living by locating in Lexington.

Arguably, the most unique advantage companies relocating to Kentucky can receive is through the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) Matching Funds Programs. These programs allow high-tech companies the opportunity to as much as double the funds they receive through the federal SBIR/STTR grant programs by getting a dollar-for-dollar match from the Kentucky Cabinet for Economic Development.

One Lexington SBIR success story is Lumenari, Inc., an advanced materials discovery company founded in Silicon Valley. With a team of PhD-level chemists and physicists, Lumenari’s choice to relocate their company from California to Lexington in 2015 was largely due to the SBIR/STTR Matching Funds Program and access to Lexington’s highly educated workforce. The business received nearly $500,000 in matched funds because of their decision to relocate to Kentucky and gained access to a community ranking in the top 10% of all U.S. counties in innovation capacity, fueled by an abundance of human capital and knowledge creation, by choosing Lexington4. Lumenari’s example illustrates the advantages a high-tech, early-stage firm can experience by moving to Lexington from expensive, tech hubs like Silicon Valley.